This article is intended for investors interested in learning more about private credit, an asset class currently gaining traction.

According to the US Federal Reserve, "private credit or private debt investments are debt-like, non-publicly traded instruments provided by non-bank entities, such as private credit funds or business development companies, to fund private businesses[1]".

Outlook and recent deals

Lately, some landmark deals have been achieved in the private credit space. For example, CoreWeave (a company that is well positioned in the generative AI boom with its GPU cloud) secured a USD7.5 billion debt financing facility led by Blackstone and Magnetar[2] in May 2024; Apollo, KKR and Stonepeak consider lending billions to the Intel Chip Joint Venture [3].

Key players in the private credit sector foresee a favorable environment ahead. Recently, Ares Management Corp. said it anticipated a pickup in deals in 2024. “The pent-up demand for M&A, the significant amount of private equity dry powder, and the demand from LPs to return capital will be conducive to an improved transaction environment this year,” said Chief Executive Officer Mike Arougheti in May 2024.

Here are the key points highlighting the current appeal of private credit:

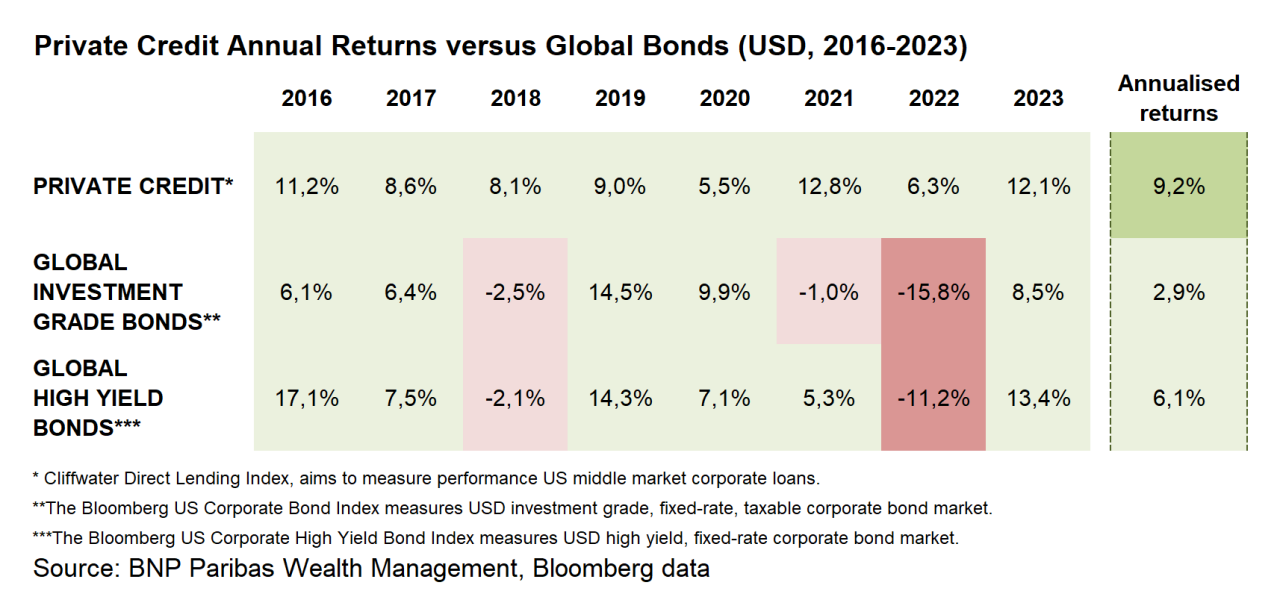

- Historical high returns that are likely to persist in the future, in our views[4]: Recent estimates suggest high-single digit to low-double digit returns for 2024. Over the past decade senior lending has returned around 9% on an annualized basis, more than twice the return on public loans, and has outperformed global equities[5]. This extra return is notably due to higher floating interest rates and illiquidity premiums of private investments.

- Filling a gap: Banks are tightening lending standards and have step back from markets such as corporate and real estate lending over the last decade, which should create more opportunities for private credit providers. Moreover, private funds can execute ever larger and more complex transactions.